does nj offer 529 tax deduction

A 529 plan is designed to help save for college. 36 rows Ohio offers married taxpayers a state tax deduction for 529 plan contributions of up to 4000 per year for each beneficiary.

Tax Benefits Nest Direct 529 College Savings Plan

In 2022 New Jerseys plan NJBEST joins the majority of states that offer residents an income tax deduction or credit for contributions to the state plan.

. NJBEST 529 College Savings Plan is a traditional NJ 529 plan that allows you to invest money today and reap tax benefits when you withdraw it to pay. More information is available on the. Some states do not offer state tax deductions or tax credits for K -12 tuition and other restrictions may apply.

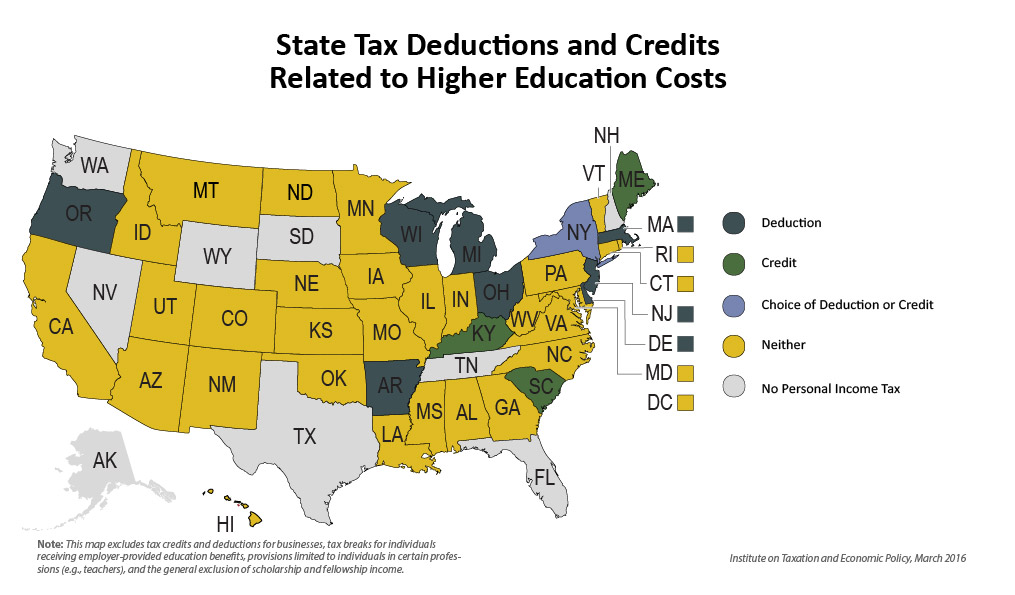

As of January 2019 there are no tax deduction benefits when making a. Putting Your Goal in Writing Will Help You Reach Your Savings Goal. New Jersey offers tax benefits and deductions when savings are put into your childs 529 savings plan.

NJ 529 tax deduction. Investments in other states 529 plans are not eligible for either the dollar-for-dollar state grant to match up. Ohio residents can deduct up to 4000 per beneficiary per year on their state taxes.

Married grandparents in Nebraska. The Vanguard Group Inc serves as the Investment Manager and. Does NJ offer 529 tax deduction.

The agreement includes a provision to allow New Jersey taxpayers to deduct 529 plan contributions of up to 10000 per year from state taxable. 2000 single or head. New Mexico All contributions to in-state 529 plans are deductible.

NJBEST 529 College Savings Plan. NJBEST New Jerseys 529 College Savings Plan is offered and. 5000 single 10000 joint.

Rowe Price College Savings Plan. Section 529 - Qualified Tuition Plans. New Jersey is the 35th state to offer an income tax benefit for residents who contribute to a 529 plan.

If you were a New Jersey homeowner or tenant you may qualify for either a property tax deduction or a refundable property tax credit. Ad Fidelity Investments Can Help You Untangle And Learn About The College Process. Unfortunately New Jersey does not offer any tax benefits for socking away.

Some states do have income taxes but no 529 plan tax deduction. Many states provide an income tax deduction for contributing to a college savings plan including New York which provides a maximum annual 10000 deduction. 52 rows Depending on where you live or where you started your 529 plan you could be eligible for one of these benefits.

Ad Tell Us About Your Savings Goal and Receive an Action Plan To Help Achieve It. Does NJ offer 529 tax deduction. New Jerseys plan doesnt offer much.

The plan NJBEST is offered through Franklin Templeton. The Vanguard 529 College Savings Plan is a Nevada Trust administered by the office of the Nevada State Treasurer. Learn More With AARP.

Contributions to such plans are not deductible but the money grows tax-free while it. Only offered to account owners and their spouses. New York Can deduct up to 5000 per year per person.

Oklahoma allows individuals to deduct up to 10000 per year and joint filers to deduct.

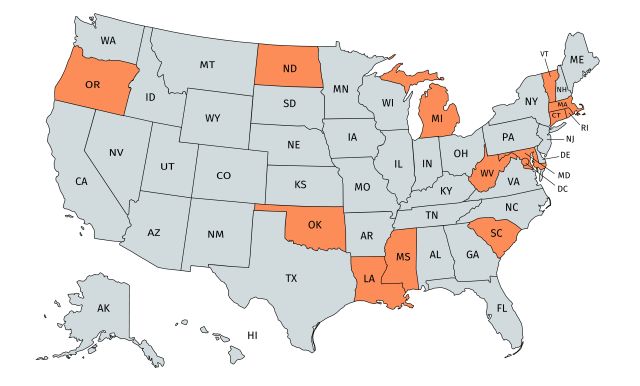

Can I Use A 529 Plan For K 12 Expenses Edchoice

The Top 9 Benefits Of 529 Plans Savingforcollege Com

Tax Deduction Rules For 529 Plans What Families Need To Know College Finance

What States Offer A Tax Deduction For 529 Plans Sootchy

How Much Is Your State S 529 Plan Tax Deduction Really Worth Savingforcollege Com

When It Comes To 529s How Good Is Your State S Tax Benefit Morningstar College Savings Plans 529 College Savings Plan Savings Plan

Using A 529 Plan From Another State Or Your Home State

Higher Education Income Tax Deductions And Credits In The States Itep

How Much Can You Contribute To A 529 Plan In 2022

How To Deduct Education Expenses H R Block School Holistic Education Home Schooling

Best 529 Plans Reviews Ratings And Rankings White Coat Investor

3 Reasons To Invest In An Out Of State 529 Plan

529 College Savings Plans All 50 States Tax Benefit Comparison Updated 2021 My Money Blog

States That Offer 529 Plan Tax Deductions Bankrate

How Do I Choose A 529 Morningstar 529 College Savings Plan College Savings Plans Saving For College

529 Tax Deductions By State 2022 Rules On Tax Benefits

529 College Savings Plans All 50 States Tax Benefit Comparison Updated 2021 My Money Blog